For quite some time, the world has been heading towards an inclusive digital approach. The year 2020, on the other hand, brought into sharp focus the urgent necessity to adapt to digital technology as much as possible. With the lockdown in place, this adaptation happened fairly fast, notably for the digital payment services in Bangladesh.

Digital payment, also known as electronic payment, is the transfer of value from one payment account to another utilizing a digital device such as a smartphone, POS (Point of Sale) terminal, or computer, as well as a digital channel of communication such as mobile wireless data or SWIFT (Society for the Worldwide Interbank Financial Telecommunication). Payments made via bank transfers, mobile money, and payment cards, including credit, debit, and prepaid cards, are all included in this description.

Background

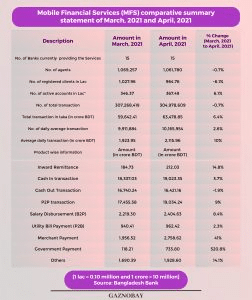

At present, fifteen MFS institutions registered with Bangladesh Bank are providing financial services in the country. Outside the registration of Bangladesh Bank, the postal department is associated with the cash service.

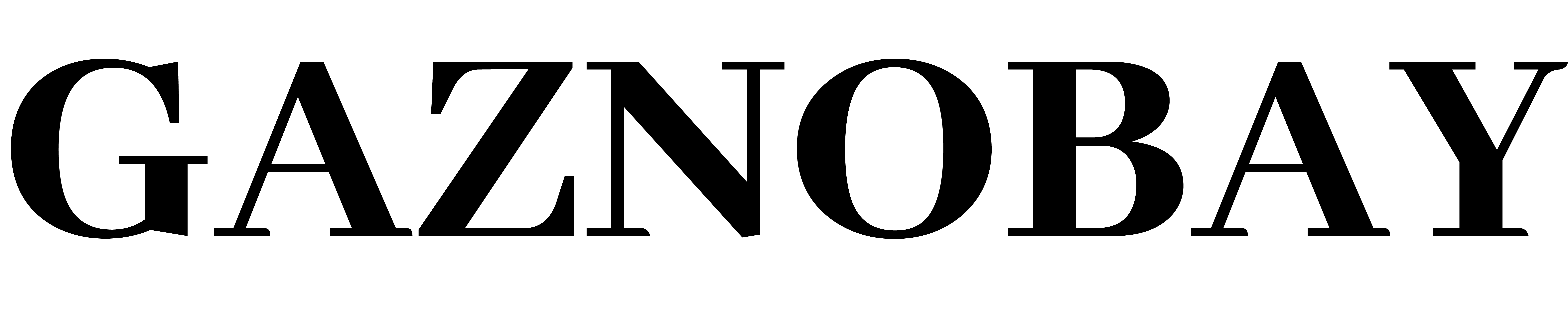

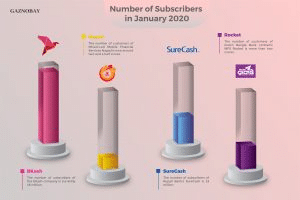

Including bKash, Rocket, Nagad, SureCash, etc., the number of mobile banking customers in the country now stands at around 14 crores. According to Bangladesh Bank, at the end of January 2020, the number of customers of this service is 10 crore 5 lakh. BKash single-handedly occupies 70% of the total MFS market. Nagad is currently in second place in terms of transactions. Dutch-Bangla Bank’s Mobile Financial Service provider Rocket is next in terms of bKash and Nagad in the fintech industry. The average daily turnover of the company exceeded Rs 500 crore a few days ago. There are 56 lakh transactions in bKash daily, in the amount of Tk. 450 crore.

Although a government institution, the postal department’s digital transaction service ‘Nagad’ has come to the market in a relatively short time. In the first 10 months of the journey, the Nagad subscribers stood at 1 crore 22 lakh. Daily transactions have exceeded Tk 100 crore and more than Tk 3 thousand crore are being transacted every month. Third Wave Technology Limited is providing this service along with the Postal Department. The postal department owns 51 percent of Nagad, while the remaining 49 percent belongs to the Third Wave. The use of digital KYC in the financial technology industry of Bangladesh was first introduced by Nagad in March 2019.

It takes only 10 seconds to open an account with digital KYC registration whereas it took 72 hours before in order to open a bKash account. In August last year, the country had a turnover of Tk 41,000 crore through MFS providers, which was Tk 23.56 crore for the same period in 2019.

According to the data of Bangladesh Bank, 1 thousand to 1 thousand Tk 746 crore are transacted daily through MFS in the country at present; 80 percent of which is through the country’s largest MFS company bKash. In January of 2021, the average daily turnover of the MFS companies was Tk 1,748 crore. The government of Bangladesh depicts that almost 7.7% of the country’s recipients make payments through mobile financial services as of the year 2020.

Number of Subscribers

The number of subscribers of the bKash company is currently 46 million. The number of customers of Mixed-Led Mobile Financial Services Nagad is now around two and a half crores. Besides, the number of subscribers of Rupali Bank’s SureCash is 23 million and the number of customers of Dutch Bangla Bank Limited’s MFS Rocket is more than two crores. The number is about 14 crores.

At the end of August last year, there were more than 10 lakh 9 thousand agents of MFS providers across the country. In the last one year, the number of customers in this sector has increased by 26.35 percent, and the number of agents has increased by 6.21 percent.

Around Eid, almost Rs 200 crore has been transacted through mobile financial service providers (MFS). Among these, 121 crore rupees have been transacted per hour through bKash. The number of transactions per hour through Nagad was about Tk 75 crore. bKash and Nagad give interest based on the money deposited by the customers. While Nagad is giving interest up to 6 percent, bKash gives an interest of up to 4 percent. On the contrary, the banks’ estimated interest is now around 7 percent. Furthermore, the rate of digital payment acceptance has risen from 30% to 60%.

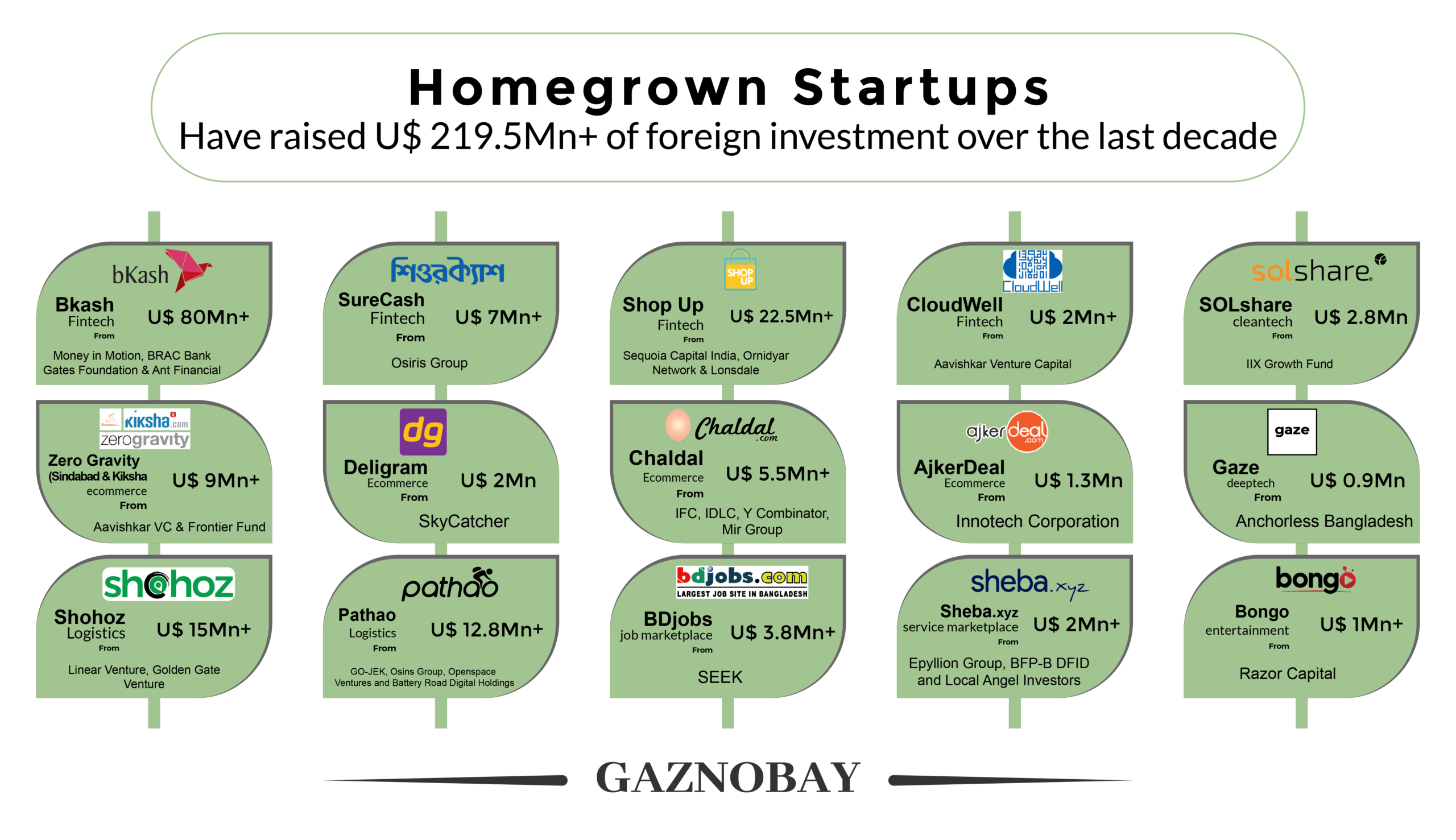

Bangladesh is a country with numerous businesses and high potential where 168.367 million people have access to mobile phones and about 101.905 million are using mobile internet. Market data shows that about 45% of people own a smartphone which is around 76.5 million Bangladeshi people having at least one smartphone in their pocket. And due to the recent COVID situation, the entire dynamic of the digital payment industry, as well as the economic condition of the country, has transformed dramatically which was never experienced before.

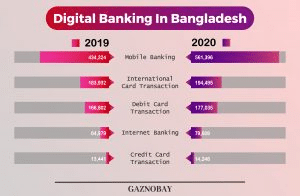

According to bdnews24.com, while speaking to e-commerce stakeholders it was found out that most of the existing companies are taking 60-70 percent of their payments through digital channels. Some companies are even operating 100% of their payment process through digital methods. According to them, the shortcomings involved in physical cash exchange can be avoided by using digital mediums such as Mobile Banking services, debit, or credit cards.

Bangladesh Bank has already provided an additional contactless limit on contactless credit cards, in the initiative driven by the increasing rate of contactless financial services worldwide such as Mastercard.

The growth rates of mobile device users and internet service users are the most promising aspects of our digital economy. As part of the government’s relentless efforts to build a society without physical financial operations, this cutting-edge technology has led to a significant increase in the acceptance of digital payments in the country. The transition from mobile banking to the digital wallet is also underway. In this way, all the financial activities like shopping, paying for electricity, gas, paying various utility bills, mobile recharge, buying tickets, hotel booking, etc. can be done easily from home.

Covid-19 Impacts on Digital Payments

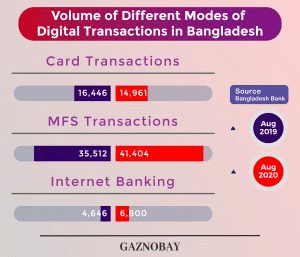

With the start of the pandemic, lockdowns were imposed across the country. This compelled people to rely more on contactless payment methods. People across the towns had to buy their necessary groceries and products via online. The easiest way out was to pay online so that they can receive their required goods and services without the need to go near crowded people. The digital payment ecosystem of Bangladesh peaked during the pandemic. Access to MFS transactions has become easier over time. The graph below shows the increase in MFS payments from 2019 to 2020.

Source: Bangladesh Bank

More people shifted towards digital payment services for their day-to-day activities due to convenience. To limit human interactions, people have chosen internet banking and MFS transactions as their payment methods. E-commerce sites and grocery shops have benefited largely due to the growth of digital payment services. The statistics from Bangladesh Bank suggest. Card transactions have dropped in 2020 while MFS transactions and Internet Banking has increased rapidly in 2020.

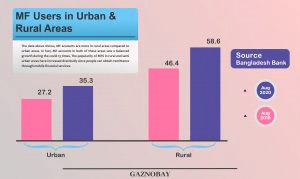

MF Users in Urban and Rural Areas

Digital services are not limited to urban areas only. The rural population has benefitted from digital services as well. In general, the use of mobile financial services is more seen in these areas as compared to other digital methods.

Source: Bangladesh Bank

The data above shows, MF accounts are more in rural areas compared to urban areas. In fact, MF accounts in both of these areas saw a balanced growth during the covid 19 times. The popularity of MFS in rural and semi-urban areas has increased drastically since people can obtain remittance through mobile financial services.

Factors That Will Drive The Payment Industry In Coming Days

- Implementation of wallet interoperability is highly required for the payment industry now. With a larger active base, this will elevate the client experience to a new level. Introducing QR-based interoperable payment will be a global phenomenon in the industry. QR has already shown to be a huge success, and Paytm’s easy scalability and cost-effectiveness paradigm are right in front of us. Around 76.5 million people in our country own a smartphone and know how to use it. The fundamental building block is already in place; now it’s time to put it into action.

- According to a UNCDF micro-merchant survey, our country has about 1.4 million micro-merchants, with 45 percent having a bank account and 98 percent having a cell phone connection. Those merchants are the customer’s last point of contact, and they act as agents for many organizations such as FMCG, MFS, Telco, and so on. There can be a leapfrog development in the payment sector by digitizing this section with the use of existing mobile devices. Safety net disbursements, money transfers, and collection can be few examples. Mini banking facilities can also be easily linked to this channel.

- It has been demonstrated that if a corporation correctly identifies the client’s problems and designs a solution, then it will be well received by its customers. Rather than just focusing on showy features, the service should try to focus on the actual key issues that customers have faced throughout Covid-19. The apps focused towards digital payment services, the ones existing in the market as well as the prospective ones which will be launched in the future should be able to handle all of the payment needs of users with 24/7 support.

Potential Opportunities In The Fintech Scenario

- Educating consumers about the MFS operators on use on a broader scale will create the opportunity for new accounts without security breaches and will increase the e-banking ratio in Bangladesh’s economy. And it will encourage customers to use it even more.

- As the people of Bangladesh do not use credit cards very much there is a potential market to introduce credit cards in.

- The increase of Smartphones and internet access to the rural areas will make financial inclusion faster and will probably include a vast area of the country.

Recommendations

- The procedure of using MFS is the most important thing to be introduced to the public of Bangladesh. This educating policy needs to be all-encompassing and vast in its scope.

- Making the processes and functions of financial services common among most platforms will make it easier to explain to people of all classes.

- Security will go a long way to creating a vast usage of MFS. This includes keeping up with the Global standards, bringing costs down, and making MFS easier for people all around the country irrespective of class, age, and gender.

Bangladesh has progressed immensely when it comes to the usage of digital payments. However, there are more opportunities lying ahead. More initiatives need to be taken to make the customers understand how different financial services work at the primary level. The government needs to make the best use of well-positioned companies and public policies in order to make digital payment systems accessible to a vast majority of the population.